Lead generation ads for financial services either result in legitimate businesses obtaining customers through misleading ads (probably in breach of anti-hawking provisions1) or they lead to scams.

My recent experience shows the role lead generation plays in scams, and how difficult it is to identify a scam.

I responded to this ad by “Rate Grid” on Facebook on 18th January.

Two days later, I received a phone call from someone who identified themselves and named a large, investment firm. I’m not naming the firm in the text here because I believe the firm wasn’t involved.

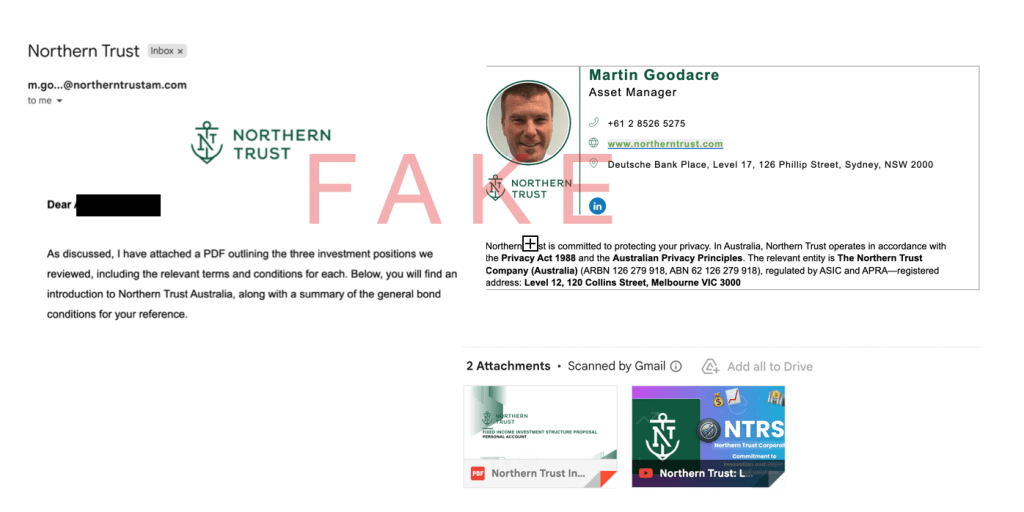

I was asked if I was interested in investing in bonds, and after a brief discussion the caller agreed to email details to me. The email contained information about investing in bonds, and (wrongly) stated that the investment would be protected by the Financial Claims Scheme in Australia. See below for some excerpts.

The email looked legitimate. The sender’s name was the same as an employee of the legitimate company (including a photo). All links in the email went to the website of the legitimate company which holds an AFSL.

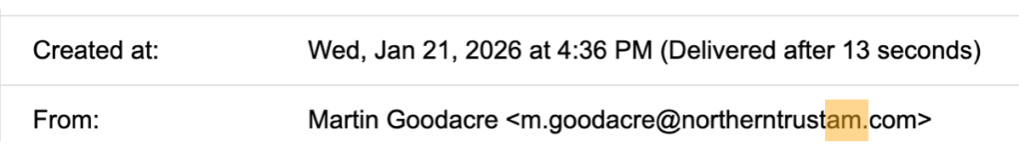

However, the domain on the email address was slightly different to the company’s website. The additional “AM” in the domain (see below) could make sense, as the company’s name ended in “Asset Management” (although they didn’t use that, or “AM” in their web address). I typed in the website using the domain in the email – and it redirected me straight to the legitimate company’s website.

While a redirect could be legitimate, for example if a business had changed its URL at some point, a check of the domain name showed that the domain name (with the additional “am”) had only been registered a few weeks ago.

These lead generation portals are being used by both licensed businesses and scammers, leading to various levels of consumer detriment. There are no simple solutions to scams, which must be attacked on many fronts. However, one positive step would be for ASIC to ban all AFSL holders from receiving individuals’ details through lead generation.

- This is likely to breach the anti-hawking provisions because the consumer is induced to consent to the contact so that the consumer can take up a product/service that is different to that offered by the advertisement). See ASIC’s RG 38.68. ↩︎